| (2) | The amounts shown in this column represent the full grant date fair value of the deferred stock awards granted in 2023, excluding any retainer fees deferred in exchange for shares, as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 718 based on the closing price of Kraft Heinz shares on the grant date ($43.12 on May 6, 2021). None of our non-management directors held any outstanding option or unvested stock awards as of the last day of our 2021 fiscal year.

(3)

During our 2021 fiscal year, Mr. Zoghbi also received compensation for his role as Advisor to Kraft Heinz’s Chief Executive Officer, an employee position. For additional information, see Corporate Governance and Board Matters—Related Person Transactions—Compensation Arrangement beginning on page 29.

The Kraft Heinz Company 2022 Proxy Statement|45

| | | | Beneficial Ownership of Kraft Heinz Stockcommon stock on the grant date ($40.84 on May 4, 2023). The following table summarizes the stock options held by current and former directors as of December 31, 2023: |

| Name | | Grant Date | | Number of Securities

Underlying Unexercised

Options Exercisable

(#) | | Number of Securities

Underlying Unexercised

Options Unexercisable

(#) | | Option

Exercise

Price

($) | | Option

Expiration

Date | | John T. Cahill | | 8/16/2019 | | 500,000 | | — | | 25.41 | | 8/16/2029 | | | | 2/26/2015 | | 176,423(a) | | — | | 52.70 | | 2/26/2025 | | | | 2/27/2014 | | 43,191(a) | | — | | 45.59 | | 2/27/2024 |

| (a) | Granted as an employee award during his prior employment with Kraft Foods Group, Inc., one of our predecessor companies. |

| (3) | Mr. Alfonso was elected to the Board effective May 4, 2023. |

| | 2024 Proxy Statement  | | | | | | | | | | | 54 |

BENEFICIAL OWNERSHIP OF STOCKDIRECTORS AND OFFICERSThe following table shows the number of shares of our common stock beneficially owned as of March 7, 20224, 2024 by each current director, director nominee, and NEO, of the Company, as well as the number of shares beneficially owned by all of our current directors and executive officers as a group. There were 1,224,894,1421,215,638,048 shares of our common stock issued and outstanding as of March 7, 2022.4, 2024. Unless otherwise indicated, each of the named individuals has, to Kraft Heinz’s knowledge, sole voting and investment power with respect to the shares shown. | | Name of Beneficial Owner | | | Shares

Owned | | | Shares

Acquirable

within

60 Days(1) | | | Deferred

Stock(2) | | | Total | | | Percentage

of Common

Stock | | | | Current Directors | | | | Gregory E. Abel | | | | | — | | | | | | 22,166 | | | | | | 47,378 | | | | | | 69,544 | | | | | | * | | | | | Alexandre Behring | | | | | 0 | | | | | | 44,333 | | | | | | 47,348 | | | | | | 91,681 | | | | | | * | | | | | John T. Cahill | | | | | 148,321 | | | | | | 633,017 | | | | | | 30,345 | | | | | | 811,683 | | | | | | * | | | | | João M. Castro-Neves | | | | | — | | | | | | — | | | | | | 19,091 | | | | | | 19,091 | | | | | | * | | | | | Lori Dickerson Fouché | | | | | — | | | | | | — | | | | | | 2,993 | | | | | | 2,993 | | | | | | * | | | | | Timothy Kenesey | | | | | — | | | | | | — | | | | | | 12,458 | | | | | | 12,458 | | | | | | * | | | | | Elio Leoni Sceti(3) | | | | | 90,000 | | | | | | — | | | | | | 10,061 | | | | | | 100,061 | | | | | | * | | | | | Susan Mulder | | | | | — | | | | | | — | | | | | | 7,688 | | | | | | 7,688 | | | | | | * | | | | | Miguel Patricio | | | | | 1,230,077 | | | | | | — | | | | | | — | | | | | | 1,230,077 | | | | | | * | | | | | John C. Pope | | | | | 10,098 | | | | | | — | | | | | | 33,560 | | | | | | 43,658 | | | | | | * | | | | | Alexandre Van Damme(4) | | | | | 14,105,315 | | | | | | — | | | | | | 26,076 | | | | | | 14,131,391 | | | | | | 1.2 | | | | | Director Nominees | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Alicia Knapp | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | James Park(5) | | | | | 596 | | | | | | — | | | | | | — | | | | | | 596 | | | | | | * | | | | | Named Executive Officers (NEOs) | | | | Miguel Patricio | | | see above | | | | Paulo Basilio | | | | | 8,796 | | | | | | 176,058 | | | | | | — | | | | | | 185,034 | | | | | | * | | | | | Carlos Abrams-Rivera | | | | | 131,608 | | | | | | — | | | | | | — | | | | | | 131,608 | | | | | | * | | | | | Rashida La Lande | | | | | 13,057 | | | | | | — | | | | | | — | | | | | | 13,057 | | | | | | * | | | | | Rafael Oliveira | | | | | 142,583 | | | | | | 191,280 | | | | | | — | | | | | | 333,863 | | | | | | * | | | | | Current directors and executive officers(6) as of March 7, 2022 as a group (21 persons) | | | | | 16,012,801 | | | | | | 1,145,298 | | | | | | 236,998 | | | | | | 17,395,097 | | | | | | 1.4 | | |

| Name of Beneficial Owner | | Shares Owned | | Shares Acquirable

within 60 Days(1) | | Deferred

Stock(2) | | Total | | Percentage of

Common Stock | | Current Directors | | | | | | | | | | | | Gregory E. Abel | | 7,886 | | — | | 63,480 | | 71,366 | | * | | Carlos Abrams-Rivera | | 358,240 | | 87,576 | | — | | 445,816 | | * | | Humberto P. Alfonso | | — | | — | | 3,166 | | 3,166 | | * | | John T. Cahill | | 152,178(3) | | 719,614 | | 38,672 | | 910,464 | | * | | Lori Dickerson Fouché | | — | | — | | 11,356 | | 11,356 | | * | | Diane Gherson | | — | | — | | 3,166 | | 3,166 | | * | | Timothy Kenesey | | — | | — | | 25,742 | | 25,742 | | * | | Alicia Knapp | | — | | — | | 6,292 | | 6,292 | | * | | Elio Leoni Sceti | | 90,000(4) | | — | | 22,799 | | 112,799 | | * | | Susan Mulder | | — | | — | | 14,675 | | 14,675 | | * | | Miguel Patricio | | 1,333,630(5) | | — | | — | | 1,333,630 | | * | | James Park | | 596 | | — | | 5,959 | | 6,292 | | * | | John C. Pope | | 10,098 | | — | | 42,878 | | 52,976 | | * | | Named Executive Officers (NEOs) | | | | | | | | | | | | Miguel Patricio | | ------------------------------see above------------------------------ | | Andre Maciel | | 174,656 | | 87,576 | | — | | 262,828 | | * | | Carlos Abrams-Rivera | | ------------------------------see above------------------------------ | | Rashida La Lande | | 18,466 | | 55,830 | | — | | 74,296 | | * | | Rafael Oliveira | | 334,142 | | 85,588 | | — | | 419,730 | | * | | Current directors and executive officers(6) as of March 4, 2024 as a group (22 persons) | | 3,033,449 | | 1,198,898 | | 238,518 | | 4,470,865 | | * |

| * | Less than 1%. | | (1) | Includes shares issuable upon settlement of RSUs, including related DEUs accrued, that will vest within 60 days of March 4, 2024 and pursuant to stock options exercisable within 60 days of March 4, 2024. | | (2) | Includes related DEUs accrued. For a description of our deferred stock, see Director Compensation—Director Compensation Program. | | (3) | Includes 37,735 shares held indirectly in an irrevocable trust for the benefit of Mr. Cahill’s children, of which Mr. Cahill’s spouse serves as a trustee. | | (4) | Includes 90,000 shares owned directly by Elma Investments Ltd., which is wholly owned by Elma Trust. Mr. Leoni Sceti is a beneficiary of Elma Trust. | | (5) | Includes 992,049 shares held indirectly in a revocable trust, of which Mr. Patricio and his spouse are co-trustees and Mr. Patricio, his spouse, and his children are beneficiaries. | | (6) | Pursuant to Item 403 of Regulation S-K, includes Mr. Oliveira, who ceased to be an executive officer effective December 31, 2023, but who was an NEO for fiscal year/2023. |

| | 2024 Proxy Statement  | 55 |

Less than 1%.

(1)

Includes shares issuable upon settlement of RSUs, including related DEUs accrued, that will vest within 60 days of March 7, 2022 and pursuant to stock options exercisable within 60 days of March 7, 2022.

(2)

Includes related DEUs accrued. For a description of our deferred stock, see Director Compensation—Director Compensation Program beginning on page 44.

(3)

Includes 90,000 shares owned directly by Elma Investments Ltd., which is wholly owned by Elma Trust. Mr. Leoni Sceti is a beneficiary of Elma Trust.

46|ir.kraftheinzcompany.com

Beneficial Ownership of Kraft Heinz Stock

(4)

Includes 14,099,315 shares owned directly by Legacy Participations S.a.r.l. (“Legacy”), a subsidiary of Societe Familiale d’Investissements S.A. (“SFI”), 7,700,000 of which are pledged to banks as collateral for loans held by SFI for the benefit of Mr. Van Damme. Mr. Van Damme is an indirect beneficial owner of equity interests in Legacy and SFI.

(5)

Includes 596 shares held in a margin account.

(6)

Pursuant to Item 403 of Regulation S-K, includes Mr. Basilio, who ceased to be an executive officer effective March 2, 2022, but who was an NEO for fiscal year 2021.

Principal Stockholders

PRINCIPAL STOCKHOLDERSThe following table displays information about persons we know were the beneficial owners of more than 5% of our issued and outstanding common stock as of March 7, 2022. | | Name and Address of Beneficial Owner | | | Amount and Nature of

Beneficial Ownership | | | Percentage of

Common Stock(1) | | | | Berkshire Hathaway(2)

3555 Farnam Street

Omaha, Nebraska 68131 | | | | | 325,442,152 | | | | | | 26.6% | | | | | 3G Funds(3)

c/o 3G Capital, Inc.

600 Third Avenue, 37th Floor

New York, New York 10016 | | | | | 185,262,701 | | | | | | 15.1% | | |

(1)

Calculated based on 1,224,894,142 shares of our issued and outstanding common stock as of March 7, 2022.

(2)

Based on the Schedule 13G/A filed on February 14, 2022 by Berkshire Hathaway, reporting beneficial ownership by Warren E. Buffett, Berkshire Hathaway, and Benjamin Moore & Co. Retirement Income Plan. Benjamin Moore & Co. is a subsidiary of Berkshire Hathaway, and Mr. Buffett may be deemed to control Berkshire Hathaway. Berkshire Hathaway and Mr. Buffett share dispositive power over 325,442,152 shares. Benjamin Moore & Co. Retirement Income Plan shares voting and dispositive power over 192,666 shares. As a result of the relationships described under Corporate Governance and Board Matters—Related Person Transactions—Shareholders’ Agreement beginning on page 29, Berkshire Hathaway and the 3G Funds may be deemed to be a group for purposes of Section 13(d) of the Exchange Act and therefore may be deemed to hold 510,704,853 shares of Kraft Heinz common stock.

(3)

Based on the Schedule 13G/A filed on February 14, 2022 by (i) 3G Global Food Holdings LP, a Cayman Islands limited partnership, (ii) 3G Global Food Holdings GP LP, a Cayman Islands limited partnership (“3G Global Food Holdings GP”), (iii) 3G Capital Partners II LP, a Cayman Islands limited partnership (“3G Capital Partners II”), (iv) 3G Capital Partners Ltd., a Cayman Islands exempted company (“3G Capital Partners Ltd”), and (v) 3G Capital Partners LP, a Cayman Islands limited partnership (“3G Capital Partners LP” and, together with 3G Global Food Holdings, 3G Global Food Holdings GP, 3G Capital Partners II and 3G Capital Partners LP, the “3G Funds”). The 3G Funds share dispositive power over 215,859,166 shares. As a result of the relationships described under Corporate Governance and Board Matters—Related Person Transactions—Shareholders’ Agreement beginning on page 29, Berkshire Hathaway and the 3G Funds may be deemed to be a group for purposes of Section 13(d) of the Exchange Act and therefore may be deemed to hold 510,704,853 shares of Kraft Heinz common stock.

Delinquent Section 16(a) Reports

4, 2024. | Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percentage of

Common Stock(1) | | Berkshire Hathaway(2) | | | | | | 3555 Farnam Street | | | | | | Omaha, Nebraska 68131 | | 325,442,152 | | 26.8% | | BlackRock(3) | | | | | | 50 Hudson Yards | | | | | | New York, New York 10001 | | 90,645,567 | | 7.5% | | The Vanguard Group(4) | | | | | | 100 Vanguard Blvd. | | | | | | Malvern, Pennsylvania 19355 | | 70,388,203 | | 5.8% |

| (1) | Calculated based on 1,215,638,048 shares of our issued and outstanding common stock as of March 4, 2024. | | (2) | Based on the Schedule 13G/A filed on February 14, 2024 by Berkshire Hathaway, reporting beneficial ownership by Warren E. Buffett, Berkshire Hathaway, and Benjamin Moore & Co. Retirement Income Plan. Benjamin Moore & Co. is a subsidiary of Berkshire Hathaway, and Mr. Buffett may be deemed to control Berkshire Hathaway. Berkshire Hathaway and Mr. Buffett share dispositive power over 325,442,152 shares. Benjamin Moore & Co. Retirement Income Plan shares voting and dispositive power over 192,666 shares. | | (3) | Based on the Schedule 13G filed on January 26, 2024 by BlackRock, Inc. (“BlackRock”). BlackRock reports sole voting power with respect to 83,527,544 shares, shared voting power with respect to 0 shares, sole dispositive power with respect to 90,645,567 shares, and shared dispositive power with respect to 0 shares. | | (4) | Based on the Schedule 13G/A filed on February 13, 2024 by The Vanguard Group, Inc. (the “Vanguard Group”). The Vanguard Group reports sole voting power with respect to 0 shares, shared voting power with respect to 1,048,315 shares, sole dispositive power with respect to 66,797,202 shares, and shared dispositive power with respect to 3,591,001 shares. |

DELINQUENT SECTION 16(A) REPORTSSection 16(a) of the Securities and Exchange Act of 1934 (the “Exchange Act”) requires our executive officers and directors, and persons who beneficially own more than 10% of our common stock (collectively, the “Reporting Persons”), to file reports of ownership and changes in ownership with the SEC. Based solely upon a review of Forms 3, 4, and 5 and amendments thereto filed electronically with the SEC by the Reporting Persons with respect to the fiscal year ended December 25, 2021,30, 2023, we believe that all filing requirements were complied with in a timely manner, with the exception of onefour transfers of common stock by Mr. Patricio to a revocable trust, of which Mr. Patricio and his spouse are co-trustees and Mr. Patricio, his spouse, and his children are beneficiaries, between 2019 and 2022, and the sale of shares of common stock by the revocable trust, which were incorrectly reported as sold directly by Mr. Patricio. These transactions were reported on Form 4 for Mr. Abrams-Rivera reporting performance conditions met for a PSU award. | | 2024 Proxy Statement  | 56 |

The Kraft Heinz Company 2022 Proxy Statement|47

Back to Contents | | | | Proposal 2. Advisory Vote to Approve Executive Compensation

| | | | | | | | | | | | | |

As required by Section 14A of the Exchange Act, we are asking our stockholders to vote to approve, on an advisory (non-binding) basis, the compensation of our NEOs as disclosed in this Proxy Statement. We currently conduct this non-binding vote to approve executive compensation annually, and, unless the Board modifies its policy on the frequency of holding the non-binding vote to approve executive compensation, the next non-binding vote to approve executive compensation will take place at the

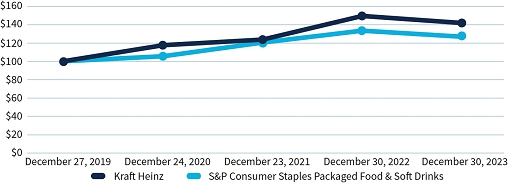

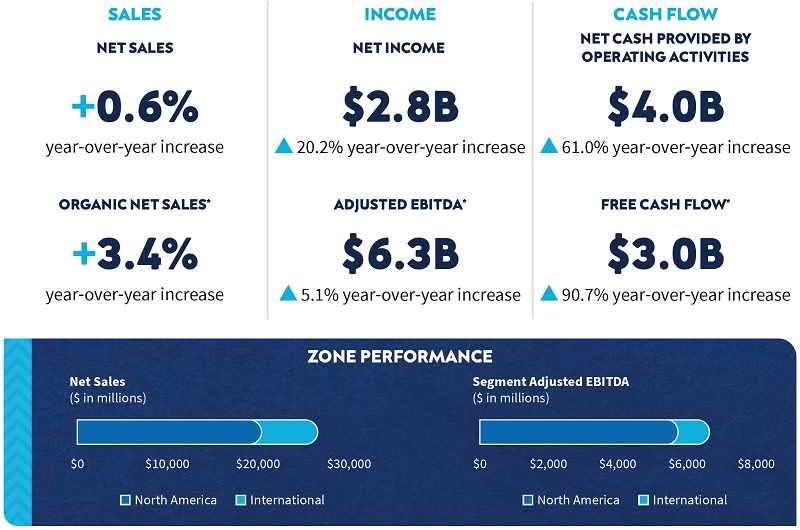

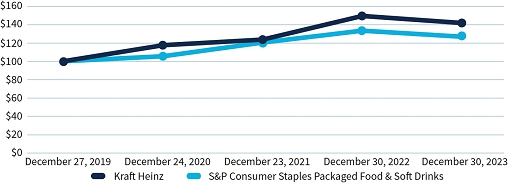

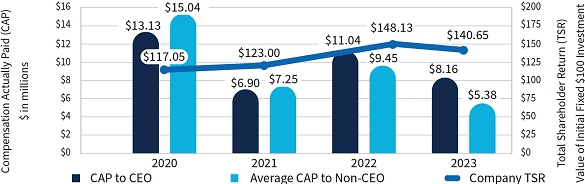

EXECUTIVE COMPENSATION2023 Annual Meeting of Stockholders.As described in detail in the Compensation Discussion and Analysis, ourCOMPENSATION HIGHLIGHTSOur executive compensation programs are designed to attract, retain,engage, and incentivize highly skilled and performance-oriented talent, including our NEOs, who are critical to our success. We believe that our compensation program effectively aligns the interests of employees and stockholders and rewards superior financial and operational performance. Please read Compensation Discussionperformance, reflects a continued focus on variable, at-risk compensation paid over the long-term, and Analysis beginningaligns the interests of our employees with those of stockholders. | | | ●MAJORITY OF NEO PAY PERFORMANCE-AND EQUITY-BASED. In 2023, approximately 75% of our NEOs’ compensation was performance-based and at-risk and approximately 66% was equity-based (including Matching RSUs granted through the Bonus Investment Plan). ●EQUITY AWARDS HEAVILY WEIGHTED TO PERFORMANCE. Effective in 2023, we enhanced the weighting of performance-based equity in our annual award mix to 70% PSUs and 30% RSUs, with vesting periods lengthened to 75% on the third anniversary and 25% on the fourth anniversary. ●PROGRAM GROUNDED IN BEST PRACTICES. Our compensation program features strong stock ownership guidelines for executives and directors, long-standing clawback terms, and no tax gross ups, enhanced benefit plans for executives, excessive risk taking, hedging, or pledging. | | ●ANNUAL CASH INCENTIVES REFLECT ACHIEVEMENT ON RIGOROUS PERFORMANCE TARGETS. In 2023, annual cash incentive payouts under our Performance Bonus Plan were based on achievement of ambitious financial performance goals, market share, or risk management excellence, and individual achievement of strategic, ESG, and employee engagement objectives. Payouts to our NEOs were 102% to 107% of targeted amounts. ●PSUs INCLUDE COMPANY-SPECIFIC MEASURES AND TSR, WITH CAP. For 2023, PSUs included performance metrics of three-year Organic Net Sales compound annual growth rate (CAGR) (30%), three-year cumulative Free Cash Flow (30%), and three-year average annual TSR (40%), aligned with our long-term growth targets, with TSR achievement capped at target in the event of a negative TSR result at the end of the performance period. ●ENHANCED STOCK OWNERSHIP GUIDELINES IN 2024. Increased requirements for our CEO to 6x base salary. |

| | 2024 Proxy Statement  | 57 |

PROPOSAL 2. ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATIONWe are asking stockholders to vote to approve, on page 50 and Executive Compensation Tables beginning on page 70 for specific details aboutan advisory basis, the compensation of our executive compensation programs.NEOs as reported in this Proxy Statement. Your vote is not intended to address any specific item of our compensation, program, but rather to address our overall approach to the compensation of our NEOs.Before voting, we recommend that you read the information regarding our compensation program, policies, and decisions for our NEOs discussed in the Compensation Discussion and Analysis and Executive Compensation Tables that follow. The Board and Compensation Committee believe that our pay-for-performance compensation philosophy has resulted in compensation for our NEOs that closely aligns to our financial results and the other performance factors described in thisthe Compensation Discussion and Analysis. In 2023, stockholders showed strong support of our executive compensation programs, with approximately 97% of votes cast in favor of our say-on-pay proposal at our 2023 Annual Meeting. As such, the Compensation Committee did not make any changes to the executive compensation program for 2023 as a result of the say-on-pay vote. In accordance with Section 14A of the Exchange Act and as a matter of good corporate governance, we are asking stockholders to approve the following advisory resolution at our 2024 Annual Meeting: RESOLVED, that the stockholders of The Kraft Heinz Company approve, on an advisory basis, the compensation paid to Kraft Heinz’s named executive officers, as disclosed in the Company’s Proxy Statement. Statement for the 2024 Annual Meeting of Stockholders, pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the Compensation Discussion and Analysis, the Executive Compensation Tables, and related narrative disclosure. This vote on NEO compensation is advisory and therefore will not be binding on Kraft Heinz, our Compensation Committee, or our Board. However, our Board and Compensation Committee value our stockholders’ opinions and will evaluate the results of this vote. At our 2021 Annual Meeting of Stockholders, the compensation of our NEOs was approved by approximately 84% of the votes cast. Effective in 2021, we made changesWe currently conduct this non-binding vote to ourapprove executive compensation program to, among other things, add a three-year relative TSR metric for PSU awards, increaseannually, and, unless the percentage of performance-based awards in the total mix of awards, and extend vesting periods to three years. For additional information on these changes, see Corporate Governance and Board Matters—Investor Engagement—2021 Executive Compensation Changes beginning on page 38. Based on this vote as well as input from and discussions with our stockholders, we believe our stockholders support our overall compensation principles, programs, and practices.We are asking our stockholders to indicate their support for the compensation of our NEOs as described in this Proxy Statement by voting in favor of the following resolution:

“RESOLVED, that Kraft Heinz’s stockholders approve, on an advisory basis, the compensation paid to Kraft Heinz’s Named Executive Officers, as disclosed in the Company’s Proxy Statement for the 2022 Annual Meeting of Stockholders, pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the Compensation Discussion and Analysis, the Executive Compensation Tables, and related narrative discussion.”

Recommendation

| | | | | The Board recommends a voteFORthe approval of our NEO compensation as disclosed in this Proxy Statement.

| | |

48|ir.kraftheinzcompany.com

| | | | Proposal 3. Advisory Vote on the Frequency of Holding an Advisory Vote to Approve Executive Compensation

| | | | | | | | | | | | | |

Section 14A of the Exchange Act requires that we provide our stockholders with the opportunity to vote, on a non-binding, advisory basis, whether future advisory votes on the compensation of our NEOs should occur every one, two, or three years. We are required to conduct this non-binding, advisory votemodifies its policy on the frequency of such future advisory votes on NEOholding the non-binding vote to approve executive compensation, the next non-binding vote to approve executive compensation will take place at least once every six years. Our prior say-on-frequency vote occurred at our 2016the 2025 Annual Meeting of Stockholders. At that meeting, our stockholders agreed with the Board’s recommendation and voted in favor of holding advisory votes to approve executive compensation every year.

After careful consideration of the benefits and consequences of each alternative, our Board recommends that the advisory vote on the compensation of our NEOs continue to be submitted to stockholders every year. In making its recommendation, our Board considered that we make compensation decisions and review compensation policies and practices annually and determined that an annual advisory vote on executive compensation is most appropriate to provide more frequent stockholder input on our compensation philosophy, policies, and practices. In addition, an annual advisory vote on executive compensation is consistent with our policy of seeking input from, and engaging in discussions with, our stockholders on corporate governance matters and our executive compensation program.

This vote is advisory, which means that the vote is not binding on us, our Board, or the Compensation Committee. While our Board and the Compensation Committee look forward to hearing from our stockholders on this proposal and will consider the outcome of the vote carefully, they may decide that it is in the best interests of our stockholders and Kraft Heinz to hold an advisory vote on executive compensation more or less frequently than the frequency approved by our stockholders.

In voting on this proposal, you should be aware that you are not voting “for” or “against” the Board’s recommendation to vote for a frequency of one year for holding future advisory votes on NEO compensation. Rather, you are voting on your preferred voting frequency by choosing the option of one year, two years, or three years, or you may abstain from voting on this proposal.

Recommendation

|

| THE BOARD RECOMMENDS A VOTE FOR THE APPROVAL OF OUR NEO COMPENSATION AS DISCLOSED IN THIS PROXY STATEMENT. |

| | 2024 Proxy Statement  | 58 |

| | | The Board recommends a vote for a ONE YEAR interval for the advisory vote on NEO compensation.

| | |

The Kraft Heinz Company 2022 Proxy Statement|49

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Discussion and Analysis Contents

| |

2024 Proxy Statement  | 59 |

Our executive compensation program is designed to complement our strategy and values, attract and retainengage qualified, world-class talent to lead our business, create sustainable growth, and drive long-term value for our stockholders. This CD&ACompensation Discussion and Analysis outlines our compensation philosophy and program and focuses on our NEOs for our 20212023 fiscal year:

| | | | | | | |

|

Miguel Patricio

| | | |

Paulo Basilio

| | | |

Carlos Abrams-Rivera

| | | |

Rashida La Lande

| | | |

Rafael Oliveira

| |

| Chief Executive

Officer

| | | | Executive Vice

President and Global

Chief Financial Officer*

| | | | Executive Vice

President and

President, North

America

| | | | Executive Vice

President, Global

General Counsel, and

Chief Sustainability

and Corporate Affairs

Officer; Corporate

Secretary

| | | | Executive Vice

President and

President, International

Markets

| |

| | | | | | | |

* In January 2022, we announcedyear.Effective December 30, 2023, the last day of our 2023 fiscal year, Mr. Basilio would stepPatricio stepped down as Global Chief Financial Officer. Effective March 2, 2022,

our CEO and became non-executive Chair of the Board and Mr. Basilio became Strategic Advisor and Andre Maciel becameOliveira stepped down as Executive Vice President and Global Chief Financial Officer.

50|ir.kraftheinzcompany.com

Compensation Discussion and Analysis

2021 Company Performance

Financial Highlights

Whether tackling challenges resulting from a once-in-a-century pandemic or finding creative ways to address rising inflation, in 2021, we leveragedPresident, International Markets. Effective December 31, 2023, the first day of our scale and increased our agility to succeed in an ever-shifting marketplace. For2024 fiscal year, 2021, we reported:Mr. Abrams-Rivera became our CEO. For our 2023 fiscal year, our NEOs were:

| | | | |

| | | | |

|  |  |  |  |

MIGUEL

PATRICIO | ANDRE

MACIEL | CARLOS

ABRAMS-RIVERA | RASHIDA

LA LANDE | RAFAEL

OLIVEIRA |

Chief Executive Officer

and Chair of the Board | Executive Vice

President and Global

Chief Financial Officer | President, Kraft Heinz* | Executive Vice

President, Global

General Counsel, and

Chief Sustainability and

Corporate Affairs

Officer** | Executive Vice

President and

President,

International Markets† |

| * | Mr. Abrams-Rivera served as Executive Vice President and President, North America through August 7, 2023, and as President, Kraft Heinz from August 8, 2023 through December 30, 2023. He became our CEO effective December 31, 2023. For additional information on our 2023 CEO Transition, see Company Overview—Our Business—CEO Transition. For additional information on Mr. Abrams-Rivera’s 2024 CEO compensation, see below under —2024 Compensation Changes—CEO Compensation Changes. |

| ** | Ms. La Lande’s title changed to Executive Vice President and Chief Legal and Corporate Affairs Officer effective December 31, 2023. |

| † | Mr. Oliveira stepped down as Executive Vice President and President, International Markets effective December 30, 2023 and served as Advisor to the CEO from December 31, 2023 to March 8, 2024. |

| |

2024 Proxy Statement  | 60 |

*

Non-GAAP financial measure. These measures are not substitutes for their comparable financial measures prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and should be viewed in addition to, and not as an alternative for, the GAAP results. For a more detailed discussion of our financial performance, including reconciliations of our non-GAAP measures to the comparable GAAP measures, see pages 40 to 44 of our 2021 Annual Report and Appendix A to this Proxy Statement.

The Kraft Heinz Company 2022 Proxy Statement|51

Compensation Discussion and Analysis

Business Highlights

We are now more than two years into our transformation and continuing to advance our strategic plan announced in September 2020. We believe our performance demonstrates the strength of our operating model, the value of our investments, and proof that our approach of combining scale and agility can yield better results. In 2021, we:

| | | | IMPROVED OUR AGILITY | | | Continued to execute business investments in our strategic plan

Maintained strong gross margin

| |

| | | | REJUVENATED OUR ICONIC BRANDS | | | Won more than 120 marketing, product, and innovation awards

Increased brand renovation projects in the United States versus 2019*

Increased our advertising spend by approximately 6.5% globally versus 2019*

| |

| | | | OPTIMIZED PRODUCT PORTFOLIO | | | Announced acquisitions and investments aimed at building our global Taste Elevation platform

Closed divestitures designed to reduced exposure to private label and commodities

Continued to take actions to expand our plant-based portfolio

| |

| | | | IMPROVED FINANCIAL FLEXIBILITY | | | Reduced net leverage to 2.9x as of December 25, 2021

Increased weighted average long-term debt maturity to approximately 15 years from approximately 14 years in 2020 and approximately 13 years in 2019

| |

| | | | ADVANCED STRATEGIC TRANSFORMATION FOR THE LONG-TERM | | | Brought in talent to strengthen culture and fill in the gap for critical skill sets

Strengthened data-driven product innovation and data analytics capabilities with investment in Just Spices

Completed global rollout of our internal creative agency, The Kitchen

| |

* Kraft Heinz views comparison to the 2019 period to be more meaningful than the comparable 2020 period

given exceptional, COVID-19-related consumer demand changes experienced in the 2020 period.

Response to COVID-19

During 2021, we continued to face challenges as a result of the COVID-19 pandemic and government and consumer responses. In response to the emergence of COVID-19 in early 2020, we implemented additional workplace safety programs and processes in all our manufacturing facilities and provided enhanced benefits to employees, many of which have continued through 2021. In 2021, we also began a limited return to office for our global office populations with heightened in-office health and safety protocols that followed local regulations. As the circumstances and impacts of COVID-19 continue to evolve, we regularly evaluate our response to adapt and protect the health and safety of our employees, while supporting consumers and our communities.

The expertise of our leadership team, the active engagement of our Board, and the efficiency and other initiatives we began to implement under our strategy prior to the pandemic empowered us to continue to respond with agility to the shifting needs of consumers and sustained product demand. As a result, for our 2021 fiscal year, we delivered financial results that met our most recent financial outlook, provided in October 2021. We did not make any adjustments to the PBP metrics or results established under our 2021 compensation program related to the COVID-19 pandemic. For additional information, see 2021 Executive Compensation Program—Annual Cash-Based Performance Bonus Plan (PBP)—Financial Multiplier beginning on page 60.52|ir.kraftheinzcompany.com

Compensation Discussion and Analysis

Compensation Structure and Goals

Compensation Governance Best Practices

| WHAT WE DO | | | What We Do | | | | | | | | | What We DoWHAT WE DO NOT Do | DO |

| Significant alignment between pay and performance

Base pay increases on merit and market alignment

Rigorous stock ownership requirements to align executives’ interests with stockholders

Maintain a clawback policy covering both cash and equity

Use double-trigger change in control provisions

Compensation Committee comprised of 100% independent directors

Retain independent consultant for risk assessment of executive and broad-based annual compensation programs

Proactive year-round engagement with stockholders on executive compensation

|  | | | | | No excessive risk taking that would threaten the reputation or sustainability of Kraft Heinz

|

| | | |

| Strong alignment between pay and performance |  | No excise tax gross ups

|

| | | |

| Base pay increases on merit and market alignment |  | No guaranteed salary increases or bonuses

|

| | | |

| Rigorous stock ownership requirements to align executives’ interests with stockholders |  | No single-trigger single-trigger change in control provisions

|

| | | |

| Maintain a robust clawback policy |  | No hedging transactions, short-selling, Kraft Heinz securities,or transacting in puts, calls, or other derivatives on Kraft Heinz securities |

| | | |

| Use double-trigger change in control provisions |  | No pledging or hedging transactions on Kraft Heinz securities without prior approval from the Corporate Secretary

No holding Kraft Heinz securities in a margin account or pledging Kraft Heinz securities as collateral for a loan without advance written notice

|

| | | |

| Compensation Committee engages an independent compensation consultant, who performs no other work for the Company, to the Corporate Secretary

advise on executive compensation matters |  | No non-qualified deferred compensation programs for executives |

| | | |

| Retain independent consultant to perform risk assessment of executive and broad-based annual compensation programs |  | No enhanced benefit programs for executives |

| | | |

| ESG-related KPIs for nearly 800 executives and employees | | |

| | | |

| |

2024 Proxy Statement  | 61 |

Total Rewards Philosophy and Core Principles

ObjectivesOur Total Rewards philosophy is designed to provide an array ofa meaningful and flexible spectrum of programs forthat support our diverse workforce.workforce and their families. We aim to grow the best people through meritocracy and pay for performance. Our compensationrewards strategies (compensation, benefits, recognition, and rewardwellbeing) aim to help our employees help themselves to LiveWell. Our global LiveWell program focuses on four wellbeing pillars-physical, emotional, financial, and social health and provides specific programs complementand resources to support our strategyemployees and Values and enable ustheir families within each of these areas. LiveWell represents our total rewards offerings that are designed to attract and retain highly-skilledengage highly skilled talent, meet individual and performance-oriented talent. Our programs are data-driven to be market competitivefamily needs, and preserveinspire, celebrate, and engage our high-performancepeople and results-oriented culture.

teams through enhanced interactions in moments that matter in an environment where employees feel productive, trusted and empowered. Our core principles are:

| | | | PAY FOR

PERFORMANCE | |  | Two-thirdsApproximately three-quarters of our executive compensation is at-risk and performance-basedperformance-driven with metrics aligned to our long-term growth strategy. Kraft Heinz performance is evaluated by:

1

|

| | (1) | Our performance, including results against short- andshort-and long-term growth targets,

2

as approved by the Compensation Committee |

| | (2) | Total return to our stockholders relative to our peers

| |

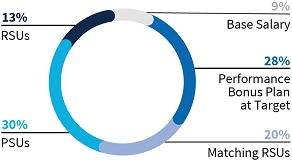

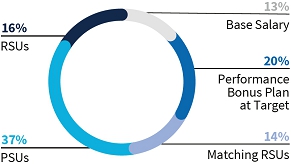

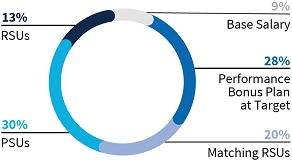

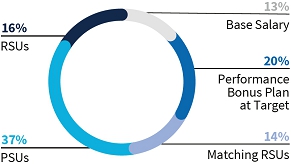

| | |  |  CEO 2023* 9% 30% 28% 13% CEO Base Salary PSUs Performance Bonus Plan at Target 20% Matching RSUs RSUs 78% Performance-Based and/or at Risk Other NEOs 2023** 10% 20% Performance Bonus Plan at Target 14% Matching RSUs 37% 71% 19% Base Salary PSUs RSUs Performance-Based and/or at Risk |

| | | Charts illustrate mix of performance-driven, at-risk compensation as a percent of target total direct compensation. We consider the Bonus Investment Plan Matching RSUs performance-driven because the match amount is determined based on achievement under the Performance Bonus Plan and at-risk because they remain subject to vesting and their value is subject to the long-term performance of our common stock. |

| | * | Reflects 2023 compensation for Mr. Patricio. For 2024, Mr. Abrams-Rivera’s compensation as CEO reflects a change in compensation philosophy by the Compensation Committee moving away from front-loaded multi-year equity grants. For additional information on Mr. Abrams-Rivera’s 2024 compensation as our CEO, see below under —2024 Compensation Changes—CEO Compensation Changes. |

| | ** | Equity award values for Mr. Abrams-Rivera reflect the pro-rata 2023 value of his sign-on new hire awards granted in March 2020 and annualized over four years. |

| ALIGN WITH

STOCKHOLDER

INTERESTS | |  | Our compensation programs are designed to align our executives’ interests with those of our stockholders.

Two-thirds

|

|  | Approximately three-quarters of our executive compensation is tied to Kraft Heinz performance.

|

|  | Our stock ownership guidelines strengthen alignment of our executive officers’ interests with those of our stockholders.

|

| |

The Kraft Heinz Company 2022 Proxy Statement|53

Compensation Discussion and Analysis

DRIVE LONG-

TERM

PROFITABLE

GROWTH | |  | | DRIVE LONG-TERM PROFITABLE GROWTH | | | We are driven by our Values We dare to do better every day, We own it, and We champion great people.

|

|  | We reward and invest in attracting, engaging, and retaining world-class talent with the highest potential to drive sustainable, long-term growth and profitability.

| |

| RECOGNIZE

INDIVIDUAL

PERFORMANCE | |  | RECOGNIZE INDIVIDUAL PERFORMANCEIndividual performance consistent with our Values and leadership principles is also taken into consideration. |

|  | We recognize and reward demonstrated skills while supporting continued development. |

| | We see non-financial performance metrics, such as our ESG targets, as critical to the long-term success of our business and reflective of our external responsibility as global leaders, and we believe they add value for our stockholders and other stakeholders. |

| | | | | | |

| |

2024 Proxy Statement  | 62 |

![[MISSING IMAGE: tm213761d1-icon_tickbred1pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-22-037838/tm213761d1-icon_tickbred1pn.gif)

IndividualYear-Round Executive Compensation-Setting Process

We have a robust annual cycle to plan, review, and execute executive compensation, with changes generally effective on the first day of our fiscal year. Highlights from our 2023 agenda include:

JANUARY TO MARCH

| ● | Evaluated and finalized previous year business performance consistentand individual contributions |

| ● | Evaluated performance and future potential of executives in order to make individual compensation decisions |

| ● | Finalized performance measures and targets for performance cycles of 2023 PSU awards and Performance Bonus Plan, aligned with our Valuesannual operating plan and long-term strategy |

| ● | Reviewed stock ownership guidelines and NEO compliance |

APRIL TO JUNE

| ● | Annual Meeting of Stockholders |

JULY TO SEPTEMBER

| ● | Reviewed talent, leadership, skills are also taken into consideration.

We recognize and reward demonstrated skills while supporting continued development.

culture strategy, and progress against talent engagement goals |

| ● | Discussed stockholder engagement efforts and feedback |

| ● | Reviewed results of say-on-pay vote of stockholders |

OCTOBER TO DECEMBER

| ● | Completed risk assessment of compensation programs |

| ● | Evaluated and set compensation and performance peer groups for the following year |

| ● | Benchmarked compensation programs and pay opportunities versus the compensation and performance peer groups |

| ● | Reviewed and approved Committee advisor and independence assessment |

| ● | Reviewed Committee Charter |

| ● | Reviewed progress against talent, leadership, culture, and DEI&B strategy |

| ● | Reviewed performance measures for inclusion in compensation program design for 2024 |

| |

The Compensation Committee oversees our executive compensation program and plans to align them with our strategy, goals, and stockholder interests. In making 2023 compensation decisions, the Compensation Committee considered a number of factors, including:

| |  | |  | |  | |  | |  |

| Compensation programs at peer companies | | Kraft Heinz’s performance over the last three years | | Our financial plan for 2020 to 2024, as part of our growth strategy and long-term outlook | | Realized pay from our historical compensation programs | | Methods of aligning executive compensation with stockholder returns | | Individual responsibilities and performance, leadership, years of experience, and long-term growth potential |

Role of Independent Consultant

Since 2022, the Compensation Committee has engaged Meridian Compensation Partners LLC (“Meridian”) as its independent compensation consultant. Meridian is hired by and reports directly to the Compensation Committee. Meridian attends meetings and executive sessions of the Committee at which compensation matters are considered and advises and provides guidance and analysis to the Compensation Committee on matters pertaining to executive and non-employee director compensation, including CEO and executive compensation plans and design, executive compensation-related regulatory matters and governance best practices, and competitive market studies. Meridian provides guidance and performs various analyses for the Compensation Committee, including peer group benchmarking and analyses regarding pay and performance alignment, incentive plan performance measures and TSR correlation, and the rigor of performance goals. Meridian does not provide any other services to Kraft Heinz or any of our affiliates and may not be engaged to provide any other services to us without the approval of the Compensation Committee.

| |

2024 Proxy Statement  | 63 |

The Compensation Committee reviews Meridian’s performance periodically and Payreviews Meridian’s independence under SEC Nasdaq rules for Performance

Our compensation programconsultants. The Compensation Committee has been designedconcluded that Meridian is independent and has no conflicts of interest relating to accomplishits engagement by the following overall goals:

We believe compensation for our executives should be tied to the success of Kraft Heinz to align executives’ interests with the long-term interests of our stockholders. Accordingly, a majority of our NEO compensation is designed to be “at risk” and dependent on achieving quantitative performance goals over both short- and long-term periods. The following charts show the compensation mix for our Chief Executive Officer (“CEO”) and other NEOs, including base salary, annual incentive compensation under the Performance Bonus Plan, and the grant date fair value of equity awards, for 2021.

(1)

Equity award values for Mr. Patricio reflect the pro-rata 2021 value of his sign-on new hire awards granted in August 2019 and annualized over the vesting period of each award (three or four years).

(2)

Equity award values for Mr. Abrams-Rivera reflect the pro-rata 2021 value of his sign-on new hire awards granted in March 2020 and annualized over four years.

54|ir.kraftheinzcompany.com

Compensation Discussion and Analysis

Committee.Role of Peer Groups

We continuously review and assess our compensation programs to create alignment with our strategies and philosophy. We believe it is important to understand the compensation programs and practices of companies with which we compete for talent, consumers, and investors. The Compensation Committee uses two peer groups of companiesgroups: the compensation peer group is used to benchmark executive compensation and compensation design, and the performance peer group is used to assessmeasure our relative performance, relativeincluding for calculating PSU payouts.

We review the selection criteria and companies in both peer groups regularly. For 2023, the Compensation Committee approved changes to market practices.

SURVEYthe peer groups indicated below. | | | | | | | | | | ADDITIONS EFFECTIVE FOR 2023 | | | | |

| | | | | | | | | | | | | | |

| | Archer-Daniels-Midland Company

Colgate-Palmolive Company | | Kimberly-Clark Corporation The Procter & Gamble Company | | | | | The J. M. Smucker Company* | | | | |

| | | | | | | | | | | | | |

| Campbell Soup Company

Conagra Brands, Inc. General Mills, Inc. Hormel Foods Corporation | | The J. M. Smucker Company* Kellanova** Mondelēz International, Inc. PepsiCo, Inc. | | The Coca-Cola Company

Tyson Foods, Inc. WK Kellogg Co** | | | Keurig Dr Pepper Inc. The Hershey Company

McCormick & Company, Incorporated | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| * | The J. M. Smucker Company was previously included in the performance peer group and was added to the compensation peer group in 2023. |

| ** | In 2023, Kellogg Company split into two publicly traded companies: Kellanova and WK Kellogg Co. Kellanova will remain in the peer group for 2024 and WK Kellogg Co will be removed. |

COMPENSATION PEER GROUP

The Compensation Committee, in consultation with the compensation consultant, reviews compensation data from the following surveycompensation peer group of companies as a reference point in evaluatingto benchmark and evaluate the compensation forof our NEOs, including our CEO, and benchmarking compensation plan designs. In addition, the Compensation Committee considers individual responsibilities and performance, leadership, years of experience, Kraft Heinz performance, and long-term growth potential.

| •

Archer-Daniels-Midland Company

•

Campbell Soup Company

•

Colgate-Palmolive Company

•

Conagra Brands, Inc.

•

General Mills, Inc.

| | | •

Hormel Foods Corporation

•

Kellogg Company

•

Kimberly-Clark Corporation

•

Mondelēz International, Inc.

•

PepsiCo, Inc.

| | | •

The Coca-Cola Company

•

The Procter & Gamble Company

•

Tyson Foods, Inc.

| |

As of our most recent analysis conducted in January 2022, our percentile rank against thisThe compensation peer group was approximately 57% for both net sales and market capitalization.

The survey peer group was established in 2016is based on publicly traded, U.S.-based organizations in the Consumer Staples Industry (under the Global Industry Classification Standard (GICS)) with revenue of approximately half to double Kraft Heinz’s net sales projected at the time of establishment of the group.sales. We consider the organizations in this industry to be peers in competition for talent, consumers, and investors. We routinely review the selection criteria and companies in the survey peer group. In early 2021, the Compensation Committee confirmed all companies were still meeting the original criteria for selection and did not make any changes to the survey peer group.

We established the following performance peer group in 2021 with the introduction of our TSR performance metric to compare our long-term incentive compensation to the delivery of results relative to the followingperformance peers, which we consider our performance peer group.

| •

Campbell Soup Company

•

Conagra Brands, Inc.

•

General Mills, Inc.

•

Hormel Foods Corporation

| | | •

J.M. Smucker Company

•

Kellogg Company

•

Mondelēz International, Inc.

•

PepsiCo, Inc.

| | | •

The Coca-Cola Company

•

Tyson Foods, Inc.

| |

We selected a narrowersubset of 13 Fast-moving Consumer Goods (FMCG) and Consumer Goods (CG) peers from our compensation peer group of peers for the performance peer group based on the use of agroup. We view these companies particularly to be impacted by similar relative performance metric, in additionexternal and market factors and to the survey peer group criteria described above.similar degrees as us. We believe measuring our results relative to this performance peer group supports our pay-for-performance philosophy and aligns with stockholder interests. We will review the selection criteria and companies in the performance peer group regularly.

| |

2024 Proxy Statement  | 64 |

The Kraft Heinz Company 2022 Proxy Statement|55

Compensation Discussion and Analysis

Oversight and 2021 Compensation Decisions

Consideration of Say-On-Pay Vote

The Compensation Committee overseesand full Board take the outcome of stockholders’ annual advisory votes on compensation seriously and are focused on continuing to solicit, understand, and respond to stockholders’ feedback through these annual votes and our stockholder engagement efforts.

Through our ongoing engagement with stockholders, we seek to elicit and consider a broad range of stockholder perspectives regarding our executive compensation program and plans to align them with our strategy, goals, and stockholder interests. In making 2021 compensation decisions,structure.

For 2023, the Compensation Committee considered a numberreviewed stockholder feedback, identified key themes across the broad range of factors, including:

![[MISSING IMAGE: tm2134352d2-fc_executpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037838/tm2134352d2-fc_executpn.jpg)

Taking into account these factors,stockholder perspectives shared, and implemented changes designed to respond to each. At our 2023 Annual Meeting, stockholders showed strong support of our executive compensation programs, with approximately 97% of votes cast in favor of our say-on-pay proposal. During our spring and fall 2023 stockholder engagement meetings, stockholders provided positive feedback on the enhancements made. In response to stockholder feedback, for 2023, we took the following actionskey compensation actions:

| ● | Appointed Ms. Gherson, who brings significant experience in compensation and people management, to the Board and Compensation Committee |

| ● | Engaged Meridian as an independent third-party compensation consultant |

| ● | Enhanced disclosures relating to the structure of our compensation program; our compensation metrics, peer groups, performance targets, and related achievement; and how equity awards are used within our compensation program to support our pay-for-performance philosophy |

| ● | Implemented the following changes to our executive compensation program: |

| WHAT WE HEARD | |  | WHAT WE DID |

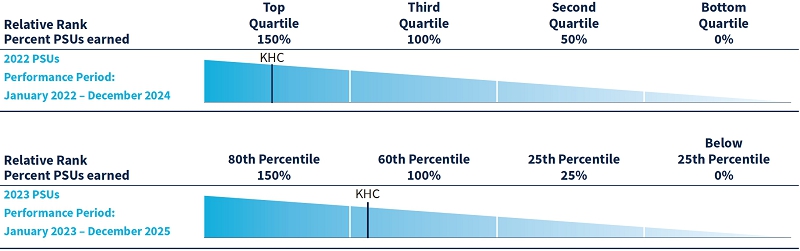

| ● Evaluate the weight of performance-based equity in equity mix | |  Increased percentage of PSUs. Changed annual equity award mix to 70% PSUs and 30% RSUs, further enhancing the weight of performance-based equity in our award mix following increases made for 2021. Increased percentage of PSUs. Changed annual equity award mix to 70% PSUs and 30% RSUs, further enhancing the weight of performance-based equity in our award mix following increases made for 2021. |

| ● Lengthen vesting periods for annual equity awards | |  Lengthened vesting periods. Changed to 75% on the third anniversary and 25% on the fourth anniversary from 100% vesting on third anniversary for annual awards, further enhancing the vesting provisions of our annual equity awards following changes made for 2021. Lengthened vesting periods. Changed to 75% on the third anniversary and 25% on the fourth anniversary from 100% vesting on third anniversary for annual awards, further enhancing the vesting provisions of our annual equity awards following changes made for 2021. |

| ● Consider Company specific financial performance metric or metrics in addition to TSR for PSUs | |  Added Company-specific financial metrics to PSUs. Added three-year Organic Net Sales compound annual growth rate (CAGR) (30%) and three-year cumulative Free Cash Flow (30%) as performance metrics in addition to three-year average annual TSR (40%), to align with our long-term growth targets, further enhancing the performance metrics for our PSUs following the introduction of TSR in 2021. Added Company-specific financial metrics to PSUs. Added three-year Organic Net Sales compound annual growth rate (CAGR) (30%) and three-year cumulative Free Cash Flow (30%) as performance metrics in addition to three-year average annual TSR (40%), to align with our long-term growth targets, further enhancing the performance metrics for our PSUs following the introduction of TSR in 2021. |

| ● Consider negative TSR for PSU awards | |  Introduced negative TSR cap. TSR achievement capped at target in the event the Company has a negative TSR result at the end of the performance period. Introduced negative TSR cap. TSR achievement capped at target in the event the Company has a negative TSR result at the end of the performance period. |

| ● Consider aligning CEO pay structure with other NEOs | |  Aligned CEO compensation structure. Aligned CEO compensation structure with our other NEOs, including awarding our CEO annual equity awards consistent with our other NEOs and offering the same bonus investment opportunity. CEO target total direct compensation is designed to be in the range of peer median. Aligned CEO compensation structure. Aligned CEO compensation structure with our other NEOs, including awarding our CEO annual equity awards consistent with our other NEOs and offering the same bonus investment opportunity. CEO target total direct compensation is designed to be in the range of peer median. |

| |

2024 Proxy Statement  | 65 |

2023 Executive Compensation Program

We believe that our compensation programs should preserve our culture of pay for performance through ownership, ambition, and meritocracy. We aim to grow the best people through meritocracy and pay for performance.

Our compensation program has been designed to take into consideration fixed elements (base salary, benefits, and limited perquisites) and variable elements (short-term incentives (annual bonus) and long-term incentives (equity awards)), with a view toward linking a significant portion of each NEO’s compensation opportunity to Kraft Heinz’s performance and their individual performance. Our compensation elements are designed to work together to recognize achieved performance, continue to drive value creation, and align our 2021 fiscal year:

•

reassessed annualemployees’ interests with those of our stockholders. When assessing our compensation program and determining the total compensation we offer to our NEOs, we take into consideration the overall rewards opportunity for each individual, including benefits and perquisites, against market position and expected / actual achieved performance relative to our peers. In line with our pay-for-performance philosophy, we generally do not offer enhanced benefits or significant perquisites to our NEOs. While our method of delivering total compensation may vary from our peers, our approach to determining target and assessing total compensation opportunity is in line with peer practice. Total cash and total direct compensation potential are designed to reflect above market median only when strong relative performance is achieved, aligning with our performance-based pay philosophy.

Our Performance Bonus Plan (PBP) financial measure maximum opportunity is limited to 120% of target and our PSU maximum opportunity is limited to 150% of target. Our maximum payout opportunity is designed to be below market practice (which peer and broader market practice generally provides for payout up to 200% of target), and to take into consideration the ambitious targets set for the plans.

Our voluntary, annual bonus investment plan (“PBP”Bonus Investment Plan”) financial targets to help ensure a challenging, yet achievable, plan that alignsplays an important role in aligning our employees’ goals with Kraft Heinz’sour stockholders, and, stockholders’ interests

•

aligned performance targetsthrough the equity match feature for 2021 performance grantsre-invested compensation, tying short-term compensation with Kraft Heinz’s total rewards philosophy,our long-term strategy,growth and operating goals

We did not make any changes to our 2021 compensation program in responsestrategy. It also operates as an employee retention tool since participants must hold their purchased shares for the three-year vesting period of the matching shares. Since the investment opportunity is tied to the COVID-19 pandemic.

level of PBP achievement, participation provides the potential for top quartile total compensation when top quartile relative performance is achieved. | |

2024 Proxy Statement  | 66 |

56|ir.kraftheinzcompany.com

Compensation Discussion and Analysis

2021 Executive Compensation Program

Elements and Objectives at a Glance

TheFor 2023, the primary elements and objectives of our compensation program for our executive officers, including our NEOs, are:

| | Element | | | | | | | Element | | | Performance Metric | | Description | Description | | | Strategy Alignment | | | Target Pay | |

PERFORMANCE-BASED AND VARIABLE FIXED Long-Term Short-Term OTHER | FIXED | | | | SHORT-TERM | | | | Base Salary | | | — | | | | | | Ongoing base cash compensation based on the executive officer’s role and responsibilities, individual job performance, experience, and market.

| | | Recruitment and retention

Market competitive

| | | — | |

| VARIABLE | | | | Performance Bonus Plan (PBP) | | | PBP EBITDA

(100%) | | | | | | Annual cash incentive with actual cash payouts linked to achievement of key annual Kraft Heinz performance targets and individual performance targets.targets, with equity investment opportunity under our Bonus Investment Plan. | | | Drive top-tier performance

Incentivize and reward performance  | | | 150-300% of annual base salary | With Bonus Investment Plan, tie short-term compensation with our long-term strategy and stockholders’ interests |

| LONG-TERMBonus Investment Plan | | — | | PSUsRSUs awarded to match an employee’s investment of 35% of their PBP payout in Kraft Heinz stock in lieu of cash and vest based upon continued employment. Matching RSUs vest 100% on the third anniversary based upon continued employment. | | Recruitment and retention Drive top-tier performance Align with stockholders’ interests Long-term value creation |

| PSUs | | Three-year relative TSR (100%(40%), three-year Organic Net Sales compound annual growth rate (CAGR) (30%), and three-year cumulative Free Cash Flow (30%) | | | | | | Linked to achievement of long-term profitability goals, and vest subject to continued employment and the achievement of relative TSR over a three-yearthe performance period.metrics, and may be awarded through an annual award or performance award. | | | Recruitment and retention

Drive top-tier performance

Align with stockholders’ interests

Long-term value creation

Incentivize achievement of specific performance goals and long-term strategy

Drive long-term profitable growth

| | | 40% of annual award target | |

| RSUs | | | — | | | | | | Vest 75% on the third anniversary and 25% on the fourth anniversary based upon continued employment and may be awarded onthrough an annual basis, a standalone basis for merit/retention,award or under our Bonus Swap Program as Matching RSUs.performance award. | | | Recruitment and retention

Drive top-tier performance

Align with stockholders’ interests

Long-term value creation

| | | 40% of annual award target | |

| Stock Options | | | We view stock options to be performance-based as their value is tied to Kraft Heinz performance and our stock price. | | | Generally vest in full after three years based on continued employment.employment and may be awarded through a performance award. | | | Recruitment and retention

Drive top-tier performance

Align with stockholders’ interests

Link realized value entirely to stock appreciation

Drive long-term profitable growth |

| Benefits and Perquisites | | — | | Limited types of non-wage compensation provided in addition to base salary, short-term incentives, and long-term incentives. | |  Market competitive |

| |

2024 Proxy Statement  | 20% of annual award target | 67 |

The Compensation Committee reviews the elements of our compensation program for our NEOs on an annual basis and generally makes changes effective January 1. As part of its review, the Compensation Committee considers market benchmark data, peer practice, scope and responsibility of the NEO’s role, and individual performance.

The Kraft Heinz Company 2022 Proxy Statement|57

Compensation Discussion and Analysis

Key Changes for 2021

We believe the strong link between pay and individual and Company performance is consistent with our strategy and culture of meritocracy and an important part of Kraft Heinz’s long-term success and driving value for our stockholders. Our long-term incentive plans reflect our commitment to our compensation program objectives and provide opportunities for our employees to build greater long-term wealth that can grow as our Company grows.

In 2020, we approved changes to our compensation plan that became effective in 2021, taking into consideration market practices, alignment with our new enterprise strategy, and feedback we received through investor engagement. These changes include:2023 NEO Compensation Snapshots

| | | |

MIGUEL

PATRICIO CEO* AND CHAIR OF THE BOARD

As CEO, Mr. Patricio was responsible for managing execution of the Company’s long-term strategy, driving key new business opportunity developments and financial performance, and setting the tone for Company culture, ethics, and compliance. | TARGET |  9% 28% 13% Base Salary Performance Bonus Plan at Target 20% Matching RSUs RSUs 30% PSUs |

| | BASE

SALARY | PERFORMANCE

BONUS PLAN | ANNUAL EQUITY

AWARD |

| ACTUAL | $1,100,000 | $3,367,980 | $3,500,006 PSUs |

| | | | $1,500,019 RSUs |

| | | | | |

CHANGES IN 2023 In connection with the Compensation Committee’s annual review process, and in consultation with the compensation consultant, the Committee completed an analysis of Mr. Patricio’s total direct compensation package and approved an increase in his annual base salary from $1 million to $1.1 million, an annual equity award consistent with our other NEOs, and revised the Bonus Investment opportunity from 50% to 35%, which is the same as other eligible employees, effective January 1, 2023, the first day of our 2023 fiscal year. |

| * | Mr. Patricio stepped down as Chief Executive Officer effective December 30, 2023, the last day of PSUs in annualour 2023 fiscal year, and merit/retention long-term incentive awardsbecame non-executive Chair of the Board. |

| | | | | | | Enhanced vesting schedules to align with longer-term focus of long-term incentive plans

| |

2024 Proxy Statement  | 68 |

![[MISSING IMAGE: tm213761d1-icon_tickbred1pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-22-037838/tm213761d1-icon_tickbred1pn.gif)

| | | |

ANDRE MACIEL EVP AND GLOBAL CHIEF FINANCIAL OFFICER

Mr. Maciel has primary responsibility for management of our financial condition, capital allocation, system of internal controls, financial reporting, investor relations, acquisitions and divestitures, capital market transactions, and information technology. | TARGET |  11% 22% 16% Base Salary Performance Bonus Plan at Target 15% Matching RSUs RSUs 36% PSUs |

| | BASE

SALARY | PERFORMANCE

BONUS PLAN | ANNUAL EQUITY

AWARD |

| ACTUAL | $725,000 | $1,466,974 | $2,384,410 PSUs |

| | | | $1,021,939 RSUs |

| | | | | |

CHANGES IN 2023 In connection with the Compensation Committee’s annual review process, and in consultation with the compensation consultant and our CEO, the Committee approved an increase in Mr. Maciel’s annual base salary from $650,000 to $725,000 and target award opportunity for the annual cash bonus from 175% to 200%, effective February 19, 2023. In making its decision to increase Mr. Maciel’s base salary and PBP target award opportunity, the Compensation Committee assessed Mr. Maciel’s performance, knowledge, and skills and the breadth and impact his accountabilities and duties as Executive Vice President and Global Chief Financial Officer and considered related market data provided by the Compensation Consultant and management. |

| | | |

CARLOS

ABRAMS-RIVERA PRESIDENT, KRAFT HEINZ*

As President, Kraft Heinz, Mr. Abrams-Rivera was responsible for leading the Company’s U.S. and Canadian operations, driving business growth through consumer-first marketing, innovation, and people development, as well as oversight over all global business functions other than finance and legal. | TARGET |  7% 17% 24% Base Salary Performance Bonus Plan at Target 12% Matching RSUs RSUs 40% PSUs |

| | BASE

SALARY | PERFORMANCE

BONUS PLAN | ANNUAL EQUITY

AWARD |

| ACTUAL | $800,000 | $2,257,373 | $3,150,067 PSUs |

| | | | $1,350,029 RSUs |

| | | | | |

CHANGES IN 2023 In connection with Mr. Abrams-Rivera becoming President, Kraft Heinz in August 2023, Mr. Abrams-Rivera was entitled to receive a special bonus payable in March 2024, equal to 20% of his 2023 actual bonus. His compensation otherwise remained unchanged. |

| * | Mr. Abrams-Rivera, who was previously our Executive Vice President and 20% Stock Options from 100% RSUs

President, North America, became President, Kraft Heinz effective August 8, 2023 and Chief Executive Officer effective December 31, 2023, the first day of our 2024 fiscal year. |

| | | Merit/Retention Awards:

Changed to 60% PSUs and 40% RSUs from 50% PSUs and 50% RSUs

| | | | Annual Awards:

Changed to 100% on third anniversary from 50% vesting on second anniversary and 50% on third anniversary

| | | Merit/Retention Awards:

Changed to 75% on third anniversary and 25% on fourth anniversary from 50% vesting on second anniversary, 25% on third anniversary, and 25% on fourth anniversary

| |

2024 Proxy Statement  | 69 |

![[MISSING IMAGE: tm2134352d2-icon_3yearpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-037838/tm2134352d2-icon_3yearpn.jpg)

| | | |

RASHIDA LA

LANDE EVP, GLOBAL GENERAL COUNSEL, AND CHIEF SUSTAINABILITY AND CORPORATE AFFAIRS OFFICER

Ms. La Lande leads the Company’s legal function, including corporate governance and securities, transactions, regulatory, intellectual property, litigation, labor and employment, sustainability and ESG oversight, government and corporate affairs. | TARGET |  13% 20% 16% Base Salary Performance Bonus Plan at Target 14% Matching RSUs RSUs 37% PSUs |

| | BASE

SALARY | PERFORMANCE

BONUS PLAN | ANNUAL EQUITY

AWARD |

| ACTUAL | $700,000 | $1,122,660 | $1,890,048 PSUs |

| | | | $810,010 RSUs |

| | | | | |

CHANGES IN 2023 No compensation changes for Ms. La Lande were made for 2023. |

| | |

RAFAEL OLIVEIRA EVP AND PRESIDENT, INTERNATIONAL MARKETS* As EVP and President, International Markets, Mr. Oliveira led the Company’s International operations, including growth, sustainability, and innovation. | Annual Awards:

TARGET

|  10% 24% 15% Base Salary Performance Bonus Plan at Target 17% Matching RSUs RSUs 34% PSUs added |

| BASE

SALARY | PERFORMANCE

BONUS PLAN | ANNUAL EQUITY

AWARD |

| ACTUAL | $721,250** | $1,667,099 | $2,344,742PSUs |

| | | $1,004,928 RSUs |

| | | | |

CHANGES IN 2023 No compensation changes for Mr. Oliveira were made for 2023. |

| * | Mr. Oliveira stepped down as Executive Vice President and President, International Markets effective December 30, 2023, the last day of our 2023 fiscal year, and served as Advisor to the CEO from December 31, 2023 to March 8, 2024. |

| ** | Mr. Oliveira is located in the annual award mix, with three-year performance period

U.K. and paid in British pounds (£). The amount shown is expressed in U.S. dollars using an exchange rate, which is the 12-month average exchange rate for the calendar year rounded to the nearest £0.01. The exchange rate used is $1 to £0.80 for 2023. |

| |

2024 Proxy Statement  | | Merit/Retention Awards:

Changed to three-year performance period from two-year performance period

| | | | Annual Awards:

PSUs added in the annual award mix, with three-year relative TSR performance metric

| | | Merit/Retention Awards:

Changed performance metric to three-year relative TSR

| 70 |

For additional information on these changes and our investor engagement program, see Corporate Governance and Board Matters—Investor Engagement beginning on page 37.At our 2021 Annual Meeting of Stockholders, the compensation of our NEOs was approved by approximately 84% of the votes cast. Based on this vote as well as input from and discussions with our stockholders, we believe our stockholders support our overall compensation principles, programs, and practices and did not make any additional changes to our compensation program as a result of this vote.CEO Compensation

There were no changes to Mr. Patricio’s compensation package from 2019. Mr. Patricio’s compensation remains heavily weighted toward performance-based elements, reflecting the Compensation Committee’s belief that the majority of Mr. Patricio’s compensation should be at risk and tied to his individual performance and Kraft Heinz’s performance. For 2021, Mr. Patricio’s base salary remained $1,000,000 and his bonus target award opportunity remained at 300% of his base salary.

In light of Mr. Patricio’s personal commitment and as an additional material inducement to his agreement to be employed by Kraft Heinz, in August 2019, Mr. Patricio received three one-time equity compensation awards. For additional information regarding Mr. Patricio’s personal commitment and these awards, see the Compensation Discussion and

58|ir.kraftheinzcompany.com

Compensation Discussion and Analysis

Analysis section of our 2019 proxy statement. Mr. Patricio is not eligible to receive additional equity awards until 2023, other than matching RSUs that may be granted to Mr. Patricio through his participation in our Bonus Swap Program. For additional information regarding our Bonus Swap Program, see below under Bonus Swap Program beginning on page 64.Base salary is the principal “fixed” element of our executive compensation. The Compensation Committee believes that it is important that each NEO receives a market-competitive base salary that provides an appropriate balance between fixed and “at risk” compensation. The initial base salary of each NEO is established in connection with their hiring. While we do not formally benchmark compensation or target compensation levels at any particular percentile, inIn establishing base salaries, we review and consider market-based survey and peer proxy data for informational purposes.

purposes and generally target market median.The annualized base salary for each NEO as of December 31 was:

| NEO | 2022 Base Salary

($) | 2023 Base Salary

($) | Change |

| Mr. Patricio | 1,000,000 | 1,100,000 | 10.00% |

| Mr. Maciel(a) | 650,000 | 725,000 | 11.60% |

| Mr. Abrams-Rivera | 800,000 | 800,000 | — |

| Ms. La Lande | 700,000 | 700,000 | — |

| Mr. Oliveira(b) | 678,824 | 721,250 | — |

| (a) | In making its decision to increase Mr. Maciel’s base salary, the Compensation Committee assessed Mr. Maciel’s performance, knowledge, and skills and the breadth and impact his accountabilities and his duties as Executive Vice President and Global Chief Financial Officer and considered related market data provided by the Compensation Consultant and management. |

| (b) | Mr. Oliveira is located in the U.K. and paid in British pounds (£). The amounts shown is expressed in U.S. dollars using an exchange rate, which is the 12-month average exchange rate for the calendar year rounded to the nearest £0.01. The exchange rates used are $1 to £0.85 for 2022 and $1 to £0.80 for 2023. Mr. Oliveira’s base salary was not changed for 2023. |

The Compensation Committee has sole responsibility for the review of Mr. Patricio’sour CEO’s compensation. Mr. PatricioOur CEO has primary responsibility for the review of the compensation of his direct reports, including the other NEOs, and provides salary recommendations to the Compensation Committee.

The annualized base salary for each NEO as of December 25, 2021 was:

| NEO | | | Base Salary

($)

| |

| Mr. Patricio | | | | | 1,000,000 | | |

| Mr. Basilio | | | | | 750,000 | | |

| Mr. Abrams-Rivera | | | | | 800,000 | | |

| Ms. La Lande | | | | | 650,000 | | |

| Mr. Oliveira | | | | | 790,411(a) | | |

(a)

Mr. Oliveira is paid in British pounds (£). The amount shown is calculated using an exchange rate of $1 to £0.73, which is the 12-month average exchange rate for the 2021 calendar year rounded to the nearest £0.01.

We believe that the base salary review process serves our pay-for-performance philosophy, because base pay increases are merit-basednot provided to all NEOs on an annual basis. Increases are performance-based and dependent on the NEO’s success and achievement in their role or for market parity. In addition, each NEO’s target annual incentive award opportunity is based on a percentage of their base salary. Therefore, as NEOs earn merit-based salary increases, their annual incentive award opportunities increase proportionately. For additional information regarding target annual incentive award opportunities, see below under

Annual Cash-Based Performance Bonus Plan—Target Award Opportunity on page 60. | |

2024 Proxy Statement  | 71 |

Annual Cash-Based Performance Bonus Plan (PBP)

The PBP is designed to motivate and reward employees who contribute positively toward our near-term business strategy and achieve their annual individual performance objectives. The formula for determining a PBP participant’s annual bonus payout is:

BASE SALARY

FOR PBP PAYOUT X TARGET AWARD OPPORTUNITY X COMPANY FINANCIAL MULTIPLIER X INDIVIDUAL PERFORMANCE SCORE = PBP PAYOUT EARNEDBase Salary

For purposes of PBP payout, we calculate base salary by averaging an employee’s annual salary as of the 15th day of each month. For any new hires or changes in salary during the fiscal year, we prorate the base salary amount based

The Kraft Heinz Company 2022 Proxy Statement|59

Compensation Discussion and Analysis

upon the duration of the individual’s service or timing of changes. For additional information regarding our NEOs’ base salaries, see above under Base Salary beginning on page 59. TARGET AWARD OPPORTUNITY

Target Award Opportunity

We establish a target award opportunity for each NEO prior to the beginning of each year, or upon their hire or establishment of increased responsibilities or changes in role, set as a percentage of the NEO’s annual base salary. For 2021,When establishing the target award opportunity, we consider the overall design of the PBP plan compared to peers, including the ambitious nature of the performance targets set versus the strategic plan, the maximum payout opportunity available under the plan, and the balance of the compensation components in the NEO’s total direct compensation relative to market.

The target award opportunity for each of our NEOs as of December 31 was:

| NEO | 2022 Target Award

Opportunity | 2023 Target Award

Opportunity | Change |

| Mr. Patricio | 300% | 300% | — |

| Mr. Maciel(a) | 175% | 200% | 14.30% |

| Mr. Abrams-Rivera | 225% | 225% | — |

| Ms. La Lande | 150% | 150% | — |

| Mr. Oliveira | 225% | 225% | — |

(a) | NEO | | | Target Award Opportunity | |

| In making its decision to increase Mr. Patricio | | | | | 300% | | |

| Maciel’s PBP target award opportunity, the Compensation Committee assessed Mr. Basilio | | | | | 250% | | |

| Mr. Abrams-Rivera | | | | | 200% | | |

| Ms. La Lande | | | | | 150% | | |

| Mr. Oliveira | | | | | 225% | | Maciel’s performance, knowledge, and skills and the breadth and impact his accountabilities and his duties as Executive Vice President and Global Chief Financial Officer and considered related market data provided by the Compensation Consultant and management. |

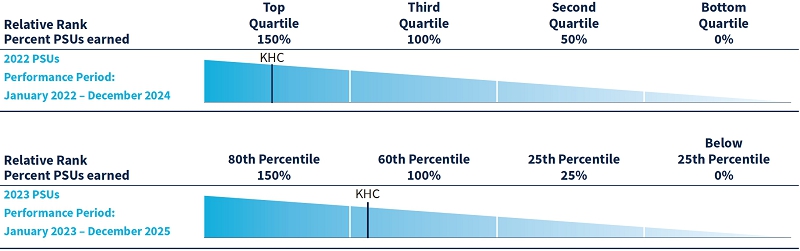

FINANCIAL MULTIPLIER

Company Financial Multiplier